Wondering how to make money from a personal finance blog? It’s simpler than you think.

Starting a personal finance blog is a great idea. You can help others while earning money yourself. A personal finance blog offers many ways to make money. From ads to affiliate marketing, the options are wide. You can share your knowledge and get paid for it.

This blog will guide you through the steps. You’ll learn how to monetize your blog effectively. Whether you are a newbie or an experienced blogger, this guide is for you. Ready to turn your passion into profit? Let’s dive in and explore the best ways to make money from your personal finance blog.

Credit: www.retirebeforedad.com

Choosing A Niche

Choosing a niche is crucial for a personal finance blog. It sets the foundation for your content, target audience, and monetization strategies. A well-defined niche helps you stand out. It makes it easier for readers to connect with your content. Below are some key steps to help you choose the right niche.

Identifying Your Expertise

Start by identifying your expertise. What topics do you know well? Your knowledge will shape your blog’s direction. For example, are you good at budgeting? Or maybe you excel in investing. Your expertise adds credibility and attracts a loyal audience.

Target Audience Analysis

Next, analyze your target audience. Who will read your blog? Are they beginners or advanced? Understand their needs and preferences. Research popular topics and questions in personal finance forums. This helps tailor your content to solve their problems.

Credit: www.makingsenseofcents.com

Creating Valuable Content

Crafting valuable content for a personal finance blog attracts readers and boosts income. Share practical tips to manage money wisely. Offer relatable advice to help improve financial habits.

Creating valuable content is the cornerstone of a successful personal finance blog. It’s what keeps readers coming back and sharing your insights with others. But what exactly makes content valuable? It should be informative, engaging, and provide practical advice that readers can implement in their own lives. As a personal finance blogger, your goal is to educate and empower your audience. You want to help them make informed decisions about their money.Content Types To Explore

Diversifying your content can keep your blog fresh and appealing. Consider writing how-to guides that break down complex financial topics into easy-to-understand steps. These guides can help readers tackle specific challenges, like budgeting for a family vacation or paying down student loans. Case studies can be another great addition. Share real-life success stories or lessons learned from financial mistakes. People love relatable content and seeing how others have navigated similar situations. Don’t shy away from listicles—they’re popular for a reason. Lists like “10 Ways to Save Money on Groceries” provide quick, actionable tips. They’re easy to read and can be a great way to introduce new readers to your blog.Frequency And Consistency

How often should you post? Consistency is more important than frequency. If you commit to posting once a week, stick to it. This builds trust with your audience, as they know when to expect new content. Find a schedule that works for you and your readers. Use tools like Google Analytics to see when your blog gets the most traffic and consider aligning your posting schedule with those days. Avoid burnout by planning content in advance. Use a content calendar to schedule posts and brainstorm topics. This approach not only helps in maintaining consistency but also keeps your content organized and varied. Creating valuable content requires effort and planning, but the rewards are worth it. What steps will you take today to ensure your content stands out?Building An Engaged Community

Building an engaged community is key to making money from your personal finance blog. A loyal audience will trust your advice, share your content, and buy your recommended products. Engaging with your readers also helps you understand their needs better, which can guide your content strategy.

Strategies For Engagement

Effective engagement strategies can turn casual readers into active community members. Respond to comments on your blog posts. Show that you value their input. Ask questions at the end of your posts to encourage discussion. Create polls and surveys to understand your audience’s preferences. Host Q&A sessions to address their concerns directly.

Utilizing Social Media

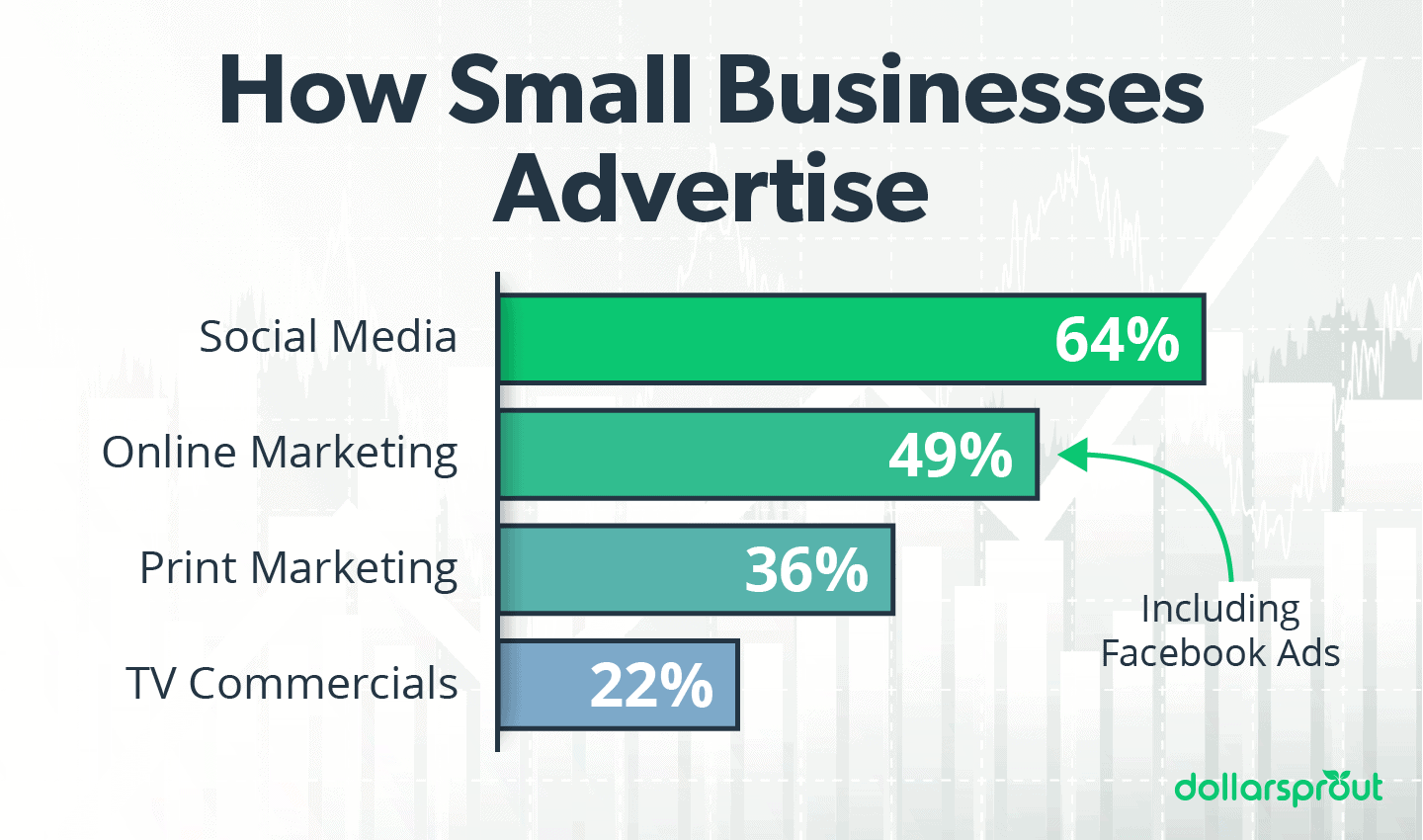

Social media platforms can help you reach a wider audience. Share your blog posts on platforms like Facebook, Twitter, and LinkedIn. Use visuals to make your content more appealing. Regularly engage with your followers by replying to their comments and messages. Join finance-related groups and forums to share your expertise. This will help you build credibility and attract more readers to your blog.

Monetization Methods

Monetization methods for personal finance blogs are vast and varied, offering unique opportunities to turn your passion into profit. Whether you’re sharing budgeting tips or investment strategies, understanding how to capitalize on your content can make all the difference. Let’s explore some effective strategies.

Affiliate Marketing

Affiliate marketing is one of the most popular ways to monetize your personal finance blog. It’s straightforward: you promote products or services and earn a commission for every sale made through your referral link.

Imagine recommending a financial book that transformed your budgeting skills. By joining the author’s affiliate program, you not only share valuable insights but also earn a percentage of each sale.

To succeed, choose products that resonate with your audience. What do they need? Are they looking for tools to manage debt or investment opportunities? Align your affiliate choices with their needs.

Sponsored Posts And Partnerships

Sponsored posts offer another lucrative avenue. Companies pay you to write about their products or services, providing a direct income stream.

Think about a budgeting app that helped you save money. By partnering with the app’s developers, you can create sponsored content showcasing your success story. Readers benefit from your experience, and you earn for sharing it.

When selecting partnerships, ensure they align with your blog’s mission. Would your audience benefit from this product or service? Authenticity is key to maintaining trust and engagement.

As you explore these monetization methods, ask yourself: What value can you offer your readers while growing your income? Balancing both is the secret to a successful personal finance blog.

Developing Digital Products

Developing digital products is a strong way to earn from a finance blog. These products provide value to readers and generate income for you. Digital products can be tailored to suit your audience’s needs. They offer flexibility and are easily accessible to your readers. Let’s explore some popular digital products for personal finance blogs.

Ebooks And Courses

Ebooks are informative, easy to create, and distribute. They offer valuable insights and tips on personal finance. Your readers can download them directly from your blog. This makes them a convenient option. Courses are interactive and provide in-depth knowledge. They can be video-based or text-based. Courses allow you to share expertise in a structured format. Readers gain practical skills to manage their finances better.

Membership And Subscription Models

Membership models create a community around your blog. They provide exclusive content to paying members. This could include private forums, webinars, or Q&A sessions. Subscription models offer regular updates or newsletters. These can be packed with valuable finance advice. Both models build a loyal audience and provide steady income. They encourage readers to engage and return to your blog.

Implementing Effective Seo

Starting a personal finance blog is a fantastic way to share your insights and help others manage their money effectively. However, to make money from your blog, you need readers to find your content. That’s where implementing effective SEO becomes crucial. SEO, or Search Engine Optimization, is the magic ingredient that helps your blog rank higher on search engines. Without it, your brilliant advice may go unnoticed. Let’s dive into some practical ways you can use SEO to boost your blog’s visibility and profitability.

Keyword Research Techniques

Understanding the language your audience uses is key. Begin by identifying keywords related to personal finance. Tools like Google Keyword Planner can provide insights into what people are searching for. Focus on long-tail keywords—these are specific phrases that might not have high search volumes but are less competitive and more targeted.

Consider your own searches. What words do you use when looking for financial advice? This personal reflection can be a goldmine for keyword ideas. Analyzing competitors’ sites also reveals popular terms in your niche. Use these strategies to curate a list of keywords that resonate with your content.

On-page And Off-page Optimization

On-page SEO refers to optimizing individual pages on your blog. Use your keywords strategically in titles, headers, and throughout your content. Ensure your blog is easy to navigate and mobile-friendly. This improves user experience and helps with search engine rankings.

Images are powerful. Optimize them by using descriptive file names and alt tags. This not only helps with SEO but also makes your blog accessible to all readers. Including internal links to your other posts can keep readers on your site longer, boosting your SEO performance.

Off-page SEO involves activities outside your blog. Building backlinks from reputable sites increases your blog’s authority. Engage with other bloggers and join personal finance forums. Sharing your content on social media platforms drives traffic to your blog, enhancing your SEO efforts.

As you implement these strategies, ask yourself: What more can you do to improve your blog’s visibility? The answer might lie in a simple tweak or a new approach. SEO is an ongoing process, and constant refinement will keep your blog thriving.

Analyzing Performance Metrics

Analyzing performance metrics is vital for personal finance blogs. It helps in understanding what content resonates with readers. Tracking these metrics can guide you in refining your strategies. This section delves into how to effectively analyze performance metrics for your blog’s success.

Using Analytics Tools

Analytics tools provide valuable insights into your blog’s performance. Google Analytics is popular for tracking visitor behavior. It shows which posts get the most views. Also, it highlights where readers are coming from. These tools help identify content that attracts traffic. Use them to spot trends and improve your content strategy.

Adjusting Strategies Based On Data

Data-driven strategies can enhance your blog’s profitability. If one post gets more views, create similar content. Adjust your posting schedule based on peak traffic times. Experiment with different post lengths. Monitor engagement levels to understand reader preferences. Use insights to tailor content that captivates your audience.

Credit: www.bloggingherway.com

Expanding Revenue Streams

Expanding revenue streams is crucial for a successful personal finance blog. By diversifying income, bloggers can increase their earnings. This approach offers more stability and reduces risk. A blog with multiple income sources can withstand market changes better. Let’s explore how you can expand your revenue streams effectively.

Diversifying Income Sources

Relying on a single income source can be risky. Consider using different methods to earn from your blog. Affiliate marketing is a popular choice. It involves promoting products and earning commissions. Sponsored posts are another option. Companies pay you to write about their products.

Offering online courses can also be lucrative. Share your finance knowledge with your audience. E-books are another product to sell. They provide valuable information and can be sold repeatedly. Each of these methods adds another revenue stream.

Exploring New Opportunities

Look for new ways to earn money from your blog. Consider hosting webinars. They are interactive and engaging. Charge a fee for exclusive content. You can also create a membership program. Offer special content for subscribers only.

Consulting services are another potential income source. Share your expertise with individuals or businesses. This could be done through one-on-one sessions. Or even group workshops. Exploring these opportunities can lead to new financial gains.

Frequently Asked Questions

Do Finance Blogs Make Money?

Yes, finance blogs can make money. Bloggers earn through ads, affiliate marketing, sponsored posts, and selling products or services.

Can You Make Money From Personal Blog?

Yes, you can make money from a personal blog. Use affiliate marketing, sponsored posts, and ads. Selling products or services also helps. Building a loyal audience is crucial for success. Consistent content and effective promotion boost earnings.

How Long Does It Take To Make $500 Per Month Blogging?

Making $500 per month blogging can take 6 months to a year. Success depends on niche, traffic, and monetization strategies.

How To Earn $1,000 From Blog?

To earn $1,000 from a blog, focus on high-quality content, SEO, affiliate marketing, sponsored posts, and selling digital products. Engage with your audience and promote your blog on social media. Consistency and patience are key to building a profitable blog.

Conclusion

Creating a personal finance blog can be rewarding. Share useful tips and insights. Build trust by being genuine and consistent. Engage with your audience regularly. Use social media to expand reach. Collaborate with other finance bloggers. Explore monetization options like ads and affiliate links.

Keep learning about finance trends. Stay updated and informed. Remember, patience is key in blogging success. Your passion for personal finance can inspire others. With dedication, you can make money and help others manage theirs. Success comes from helping readers, not just earning money.